No need for electric shocks to reduce public debt

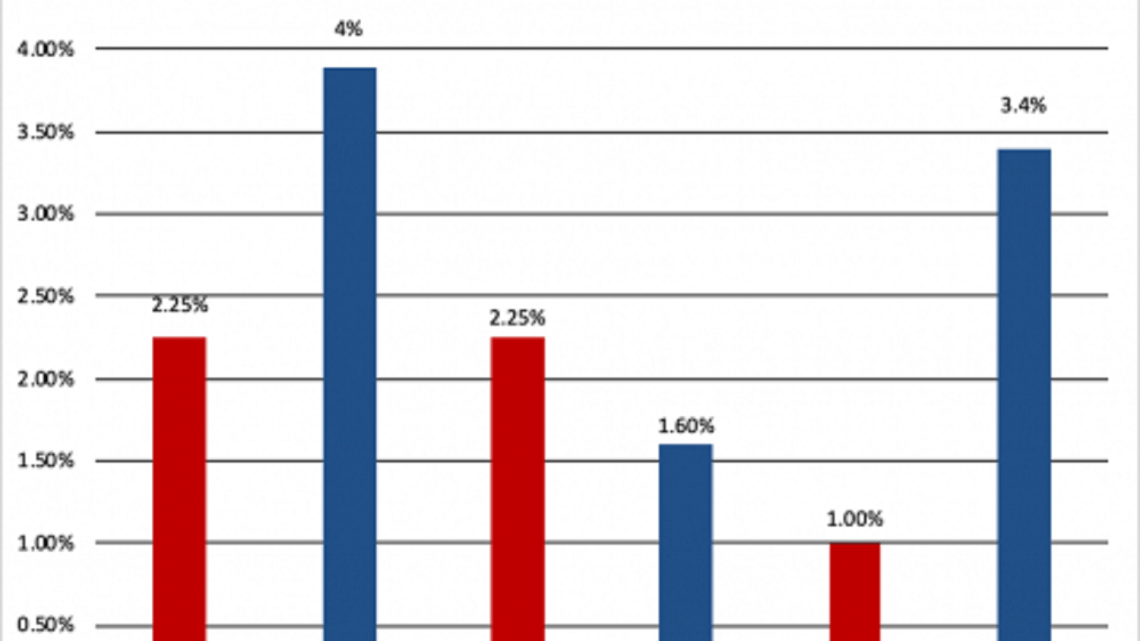

April 23, 2024See for yourself the impressive improvement in the Debt/GDP ratio of Greece and Portugal! Yes, inflation works very well to lighten the burden of public debts, provided we fix the duration of our loans and do not issue inflation-indexed debt. The deprivations inflicted on our populations are much more a matter of punitive intent than…